Date: December 16, 2025

1. Introduction

Larsen & Toubro Limited (NSE: LT) stands as a prominent Indian multinational conglomerate with a diversified portfolio spanning numerous high-impact sectors. As of December 16, 2025, the company remains highly relevant and is in significant focus due to its robust financial performance, strategic expansion into future-growth areas, strong order book, and positive market sentiment. L&T's extensive operations span critical sectors of the economy, including infrastructure, heavy engineering, power, hydrocarbon, defence, information technology & technology services, financial services, and real estate. The L&T Group comprises numerous subsidiaries, associate companies, joint ventures, and jointly held operations, operating in over 50 countries worldwide.

L&T is currently in focus for several key reasons: its robust financial performance and order book (Q2 FY26 consolidated net profit up 15.6% to ₹3,926 crore, order book at ₹667,047 crore), strategic expansion into high-growth sectors like nuclear power, green energy, semiconductor design, and data centers, and a growing footprint in defence. Its significant international presence, contributing 49% to its order book, further solidifies its position. Goldman Sachs recently upgraded L&T stock to "Buy" with a ₹5,000 price target, citing its positioning for growth in emerging sectors. Having achieved its 'Lakshya 2026' goals a year early, L&T is now developing 'Lakshya 2031', emphasizing deepening existing strengths and exploring new geographies and high-growth businesses.

2. Historical Background

Larsen & Toubro's journey is a testament to adaptability and strategic foresight. Founded in 1938 in Mumbai by two Danish engineers, Henning Holck-Larsen and Søren Kristian Toubro, it began as a partnership importing machinery. The outbreak of World War II forced a pivotal shift from trading to local manufacturing, leading to its first workshop in 1944. The company was formally incorporated in 1946 and became a public limited company in December 1950.

Early milestones include securing a major order for a soda ash plant for the Tata Group in 1940, marketing earth-moving equipment from Caterpillar in 1945, and incorporating Engineering Construction & Contracts Ltd. (ECC) for construction projects in 1946. L&T launched its first major product, the 'L&T Series 100' switchgear, in 1947 and acquired significant land in Powai, Mumbai, for a future manufacturing hub in 1948. A landmark achievement in 1961 was the contract to construct India's first nuclear power plant at Tarapur, a project personally chosen by Dr. Homi J. Bhabha. The 1970s and 80s saw deeper collaboration with DRDO for defense systems.

Key transformations include the initial pivot from trading to manufacturing, aggressive diversification into a multi-sector conglomerate by the 1990s, and a strategic refocus in the late 1990s to divest non-core businesses (like cement in 2003) and concentrate on high-value engineering and large-scale infrastructure. The 2000s onwards marked global expansion, entry into IT services (L&T Infotech, now LTIMindtree), and hydrocarbon engineering. More recently, L&T has embraced digital transformation, deepened its role in defense and space, and secured significant projects in green energy and digital infrastructure, cementing its role as a high-tech, engineering-driven global player.

3. Business Model

Larsen & Toubro (L&T) operates a highly diversified business model encompassing engineering, construction, manufacturing, technology, and financial services, with a strong global presence in over 50 countries. The company's consolidated revenue for FY2024-25 was ₹2,55,734 crore, growing 15.7%, with international revenue contributing a significant 50%. Its order book stood at a record ₹5,79,137 crore as of March 31, 2025, providing multi-year revenue visibility.

Key Segments and Product Lines:

- Infrastructure Projects: A major revenue driver, including Buildings & Factories, Transportation Infrastructure (high-speed rail, airports, metros), Heavy Civil Infrastructure, Power Transmission & Distribution, Renewable Energy Installations (solar, wind), Water & Effluent Treatment, and Minerals & Metals Processing.

- Energy Projects: Encompasses Hydrocarbon operations (onshore/offshore oil & gas, refineries), CarbonLite solutions, and Green & Clean Energy ventures (alkaline electrolysers for hydrogen, Small Modular Reactors (SMRs), renewable diesel).

- Hi-Tech Manufacturing: Shipbuilding (warships, submarines), Defence Systems (artillery, air defence, armored platforms), Aerospace (hardware for ISRO), and Heavy Engineering (custom equipment for power, petrochemicals, oil & gas). Strategic collaboration with Komatsu for construction equipment.

- IT & Technology Services: Through LTIMindtree (IT consulting, digital transformation), L&T Technology Services (ER&D services), L&T Semiconductor Technology (fabless design, acquired SiliConch Systems), L&T EduTech, L&T SuFin (B2B marketplace), and L&T Cloudfinity (data centers, cloud, AI).

- Financial Services: Through L&T Finance, offering diversified loan portfolios (rural, farmer, urban, SME finance). Loan book at ₹95,000 crore as of March 31, 2025.

- Other Businesses: L&T Realty (real estate development) and Development Projects (e.g., Nabha Power Limited).

Customer Base:

L&T serves a broad global customer base, including:

- Government and Public Sector Undertakings: For large-scale infrastructure, defense, and power projects.

- Private Sector Enterprises: Across oil & gas, petrochemicals, manufacturing, IT, and real estate.

- International Clients: Predominantly in the Middle East and GCC countries.

- Developers and Businesses: Via its B2B marketplace and realty services.

- Retail and SME Customers: Through its financial services.

4. Stock Performance Overview

Larsen & Toubro (NSE: LT) has demonstrated robust long-term stock performance, marked by significant growth over the past decade, despite some short-term fluctuations. As of December 16, 2025, the stock is trading around ₹4,060 – ₹4,064.

1-Year Stock Performance (as of December 16, 2025):

Over the past year, L&T has shown positive returns of approximately 4.7% to 6.74%. The stock hit a 52-week high of ₹4,140 on November 27, 2025, and a 52-week low of ₹2,965.30 on April 7, 2025. Recent performance indicates a strong rally of 14.11% in the last three months of 2025.

5-Year Stock Performance (as of December 16, 2025):

L&T has delivered substantial returns over the last five years, with the stock price appreciating by approximately 220.13% to 284.18%. This long-term performance reflects the company's strong growth trajectory and resilience.

10-Year Stock Performance (as of December 16, 2025):

Over the past decade, L&T has provided impressive returns, with the 10-year return standing at approximately 375.3% to 412.9%. This significant appreciation is a testament to L&T's consistent growth and strong market position.

Notable Moves and Events:

- Stock Splits: L&T has executed five stock splits, most recently a 3-for-2 split on July 13, 2017.

- Dividends: The company has a consistent history of paying dividends, with the last dividend of ₹34 paid on June 3, 2025, yielding 0.83%.

- Analyst Upgrades: Goldman Sachs upgraded L&T to 'Buy' in late 2025 with a target price of ₹5,000.

- Business Developments: The company has consistently secured "significant" orders across various segments and recently approved a scheme to transfer its realty business to a subsidiary, L&T Realty Properties.

5. Financial Performance

Larsen & Toubro Limited (NSE: LT) has demonstrated robust financial performance, with its latest earnings report for Q2 FY2025-26 (ended September 30, 2025) highlighting significant growth. As of December 16, 2025, the company shows strong revenue expansion, healthy margins, a substantial order book, manageable debt, and positive valuation indicators.

Latest Earnings (Q2 FY2025-26, ended September 30, 2025):

- Net Profit (PAT): ₹3,926 crore, a 15.63% increase YoY.

- Earnings Per Share (EPS): ₹28.53 diluted normalized EPS.

Revenue Growth:

- Total Revenue: ₹69,367.81 crore for Q2 FY26, up 10.71% YoY.

- Revenue from Operations: ₹67,984 crore, up 10% YoY.

- Half-Year Performance (H1 FY26): Consolidated revenues of ₹131,662 crore, a 13% YoY growth, with international revenues contributing 54%.

Margins:

- Net Profit Margin: 5.66% for Q2 FY26, a 4.44% improvement YoY.

- Operating Margin (EBITDA Margin): EBITDA rose 7% YoY to ₹6,807 crore, with an EBITDA margin of 10.1%.

Debt:

- Debt-to-Equity Ratio: 1.36 as of December 15, 2025. Gross Debt/Equity Ratio was 1.11, and Net Debt/Equity Ratio was 0.64 for Q2 FY25.

Cash Flow:

- Strong free cash flows were a highlight of Q2 FY25, improving by 140 basis points QoQ and 80 basis points YoY.

Valuation Metrics (as of December 12-16, 2025):

- Share Price: Around ₹4,092.30.

- Market Capitalization: Approximately ₹5,60,415 crore to ₹5,62,918 crore.

- P/E Ratio (TTM): 30.68 to 34.33.

- P/B Ratio: 4.77 to 4.86.

- Dividend Yield: 0.83%.

- Beta: 1.38, indicating higher volatility than the market.

L&T's strong financial position is driven by robust order inflows (consolidated order book grew 15% to ₹667,047 crore as of September 30, 2025) and consistent execution across its diverse business segments.

6. Leadership and Management

As of December 16, 2025, Larsen & Toubro Limited (NSE: LT) is led by a seasoned management team and a diverse board of directors, operating under a strategic vision that emphasizes digitalization, green energy, and expansion into new technological frontiers. The company maintains a strong focus on corporate governance and transparency.

CEO and Leadership Team:

S. N. Subrahmanyan (SNS) serves as the Chairman & Managing Director, having assumed the role of CEO & MD in July 2017 and Chairman and MD on October 1, 2023. He is credited with making L&T's infrastructure business the largest in India and is focused on driving digitalization, technology adoption, green energy transition, and a people-centric culture. He also chairs L&T Finance Holdings, LTIMindtree, and L&T Technology Services.

Key members include:

- Subramanian Sarma: Deputy Managing Director & President, responsible for Hydrocarbon, Carbonlite Solutions, Green & Clean Energy, Asset Management, and Offshore Wind.

- R. Shankar Raman: President, Whole-time Director & Chief Financial Officer (CFO).

- S. V. Desai: Whole-time Director & Senior Executive Vice President (Civil Infrastructure).

- T. Madhava Das: Whole-time Director & Senior Executive Vice President (Utilities).

Board of Directors:

The Board comprises the Chairman & Managing Director, 5 Executive Directors, and 9 Non-executive Directors, adhering to a framework that separates governance and executive management.

Strategy:

L&T is finalizing its new five-year strategic plan, "Lakshya 2026-2031," aiming to double revenue every five years. The strategy focuses on streamlining existing businesses, building upon established platforms, and exiting non-core, commoditized segments. Key strategic areas include:

- Digitalization and Technology: Leveraging AI, big data, and predictive analytics.

- Green Energy: Significant investments in electrolyzers and hydrogen projects.

- Semiconductors: Entry into semiconductor design services.

- Data Centers & Cloud: Owning and operating data centers and investing in GPU-based cloud services.

- Real Estate: Consolidating L&T Realty for expansion.

- Geographic Focus: Doubling down on India and the Middle East.

- Targeted Investments: Pursuing "tuck-in" acquisitions for specialized technologies.

Governance Reputation:

L&T has a strong corporate governance philosophy rooted in transparency, integrity, professionalism, and accountability. Its framework includes an independent board, various committees, and policies on internal control, code of conduct, whistleblowing, and related party transactions, with a strong focus on sustainability.

7. Products, Services, and Innovations

Larsen & Toubro Limited (NSE: LT) continues to bolster its position through a diversified portfolio, strategic innovations, robust R&D, a growing patent library, and a clear competitive edge in both domestic and international markets as of December 16, 2025.

Current Offerings:

- Infrastructure Projects: Buildings & Factories, Heavy Civil, Water & Effluent Treatment, Power Transmission & Distribution, Transportation, Minerals & Metals, and a dedicated Renewables vertical.

- Energy Projects: Hydrocarbon (onshore/offshore oil & gas, refineries), CarbonLite Solutions, Green & Clean Energy (green hydrogen, ammonia, solar EPC, offshore wind, battery storage).

- Hi-Tech Manufacturing: Heavy Engineering, Precision Engineering & Systems, Electrolyser Manufacturing, Shipbuilding, Defence Systems (India's largest private-sector defense manufacturer by revenue), and Aerospace.

- IT & Technology Services: LTIMindtree, L&T Technology Services (ER&D leader), Digital Platforms, Data Centers, and Semiconductor Design (L&T Semiconductor Technology).

- Financial Services: Through L&T Finance.

- Real Estate (Realty): L&T Realty.

- Allied Businesses: B2B e-commerce (L&T-SuFin) and EduTech (L&T EduTech).

Innovation Pipelines & R&D:

L&T is strategically investing in future-ready technologies:

- Digital Transformation and AI: Integrating AI for predictive project management, digital twin modeling, robotics, automated machinery, drone monitoring, cloud-based systems, and BIM. LTTS is a leader in AI, Digital & R&D Consulting.

- Green Energy Focus: Committing up to $12 billion over five years, with one-third for clean energy, aiming for 2-3 million tonnes of green hydrogen/ammonia capacity. LTEGL is leading this, exploring fuel cells, grid-scale batteries, and hydrogen vending.

- Semiconductor Design: Entered this sector for high-margin opportunities.

- R&D Infrastructure: Allocated ₹479.4 crore towards R&D over the last 3 years, supported by 144 R&D engineers and scientists. Dedicated centers focus on Land, Marine, Aerospace, and Electronics.

- Partnerships: Collaborates with IITs, NITs, and MIT Media Lab for AI-led innovations.

Patents:

L&T demonstrates a strong commitment to intellectual property. As of September 30, 2025, L&T Technology Services (LTTS) held 1,601 patents, with 216 in AI/Generative AI. Overall, L&T globally holds 2,092 patents across 1,955 unique patent families, with India as the primary R&D and filing center.

Competitive Edge:

- Integrated Business Model: Combining EPC with technology services.

- Robust Order Book: Record ₹6.67 trillion as of September 2025, ensuring revenue visibility.

- Diversified Portfolio: Resilience against sector-specific fluctuations.

- Unparalleled Execution Capabilities: Proven track record in complex projects.

- Strategic Global Expansion: Strong presence in the Middle East and growing focus on Africa.

- Technological Leadership: Continuous investment in digital transformation, AI, and advanced engineering.

- Commitment to Sustainability: Strategic positioning in green energy, aiming for carbon and water neutrality.

- Financial Stability: Strong financial performance supporting future investments.

- Indigenous Defense Capabilities: Key player in India's defense sector.

8. Competitive Landscape

Larsen & Toubro Limited (NSE: LT) operates in a highly competitive landscape across its various segments, facing a mix of domestic and international players. As of December 16, 2025, L&T maintains a dominant position, particularly within the Indian infrastructure and construction sector, while also expanding its global footprint.

Industry Rivals:

- Indian Conglomerates: Tata Group (Tata Projects), Reliance Industries Limited, Adani Group (Adani Infrastructure, Adani Ports), Godrej Group, Mahindra & Mahindra.

- Construction & Infrastructure (Domestic): Shapoorji Pallonji, Punj Lloyd, Gammon India, NCC Limited, J Kumar Infraprojects, GMR Infrastructure, Ircon International, Afcons Infrastructure, Kalpataru Projects International, Rail Vikas Nigam Ltd., NBCC (India) Ltd.

- Global Engineering & Technology Players: Siemens Global, ABB, General Electric (GE), Hitachi, Bosch, Schneider Electric, Honeywell, Bharat Heavy Electricals Limited (BHEL), ThyssenKrupp.

- Emerging Technology Service Providers: DigitalOcean, UST, Happiest Minds (in data center and cloud services).

Market Share:

L&T is recognized as a market leader in the Indian construction services sector.

- FY 2024-25 revenue: ₹2,55,734 crore, with 50% from international operations.

- Consolidated order book (March 31, 2025): ₹5,79,137 crore, with 62% from infrastructure.

- Market Capitalization (December 2025): Approximately $61.43 billion USD.

- The Indian construction market is projected for significant growth, with L&T as a major beneficiary.

Competitive Strengths:

- Diversified Portfolio: Multiple revenue streams across high-growth sectors.

- Strong Brand Reputation: Long history of innovation, quality, and timely project execution.

- Robust Financial Position: Consistent growth, high order book, and strong profitability.

- Technological Prowess: Investments in GenAI, semiconductor design, green hydrogen, data centers.

- Extensive Global Presence: Strong footprint in the Middle East, contributing significantly to international orders.

- Human Capital: Focus on knowledge enhancement and skill development.

- Sustainability Commitment: Emphasis on a greener portfolio and sustainable solutions.

Competitive Weaknesses:

- Historical Domestic Reliance: While increasing international share, past dependence on the Indian market.

- Increasing Debt: Rising borrowings, mainly from financial services, could impact flexibility.

- Innovation Lag (in some areas): May lag behind leading global competitors in certain cutting-edge technologies.

- Labor Skill Gaps & Rising Costs: Challenges in finding skilled labor and increasing labor costs.

- Intense Competition: Stable earnings attract numerous rivals, pressuring sales and profitability.

- Exposure to Macro/Regulatory Factors: Vulnerability to economic uncertainties, policy changes, and raw material price volatility.

9. Industry and Market Trends

Larsen & Toubro Limited (NSE: LT) operates across diverse high-impact sectors, primarily infrastructure, heavy engineering, manufacturing, and technology services. As of December 16, 2025, the company’s performance and outlook are significantly shaped by robust sector-level trends, evolving macro drivers, ongoing supply chain dynamics, and inherent cyclical effects.

Sector-Level Trends:

- Infrastructure Sector Boom: India’s infrastructure sector is projected to reach $190.70 billion in 2025 and $280.60 billion by 2030 (8% CAGR), driven by government spending under initiatives like the National Infrastructure Pipeline (NIP) and PM Gati Shakti. L&T's Infrastructure Projects segment is the primary beneficiary.

- Manufacturing Surge: Policy-driven growth with initiatives like the Production Linked Incentive (PLI) scheme is establishing India as a global manufacturing hub. L&T's heavy engineering and manufacturing segments benefit from this, especially in defense and high-complexity production.

- Energy Transition: Rapid global shift towards renewables and clean technologies. L&T is actively pursuing green energy projects, scaling electrolyzer manufacturing, and involved in green hydrogen plants.

- Digitalization and Smart Infrastructure: Integration of digital tools, AI, IIoT, and digital twins for efficiency. Opportunities in data centers, digital highways, and smart cities are key focus areas.

Macro Drivers:

- Government Capital Expenditure: The Indian government's commitment to infrastructure-led growth is a primary driver, with the Union Budget 2025-26 increasing capital investment outlay to ₹11.21 lakh crore.

- Robust Domestic Demand: Strong domestic demand fuels growth across infrastructure and manufacturing, with over 50% of Indian manufacturers planning new investments.

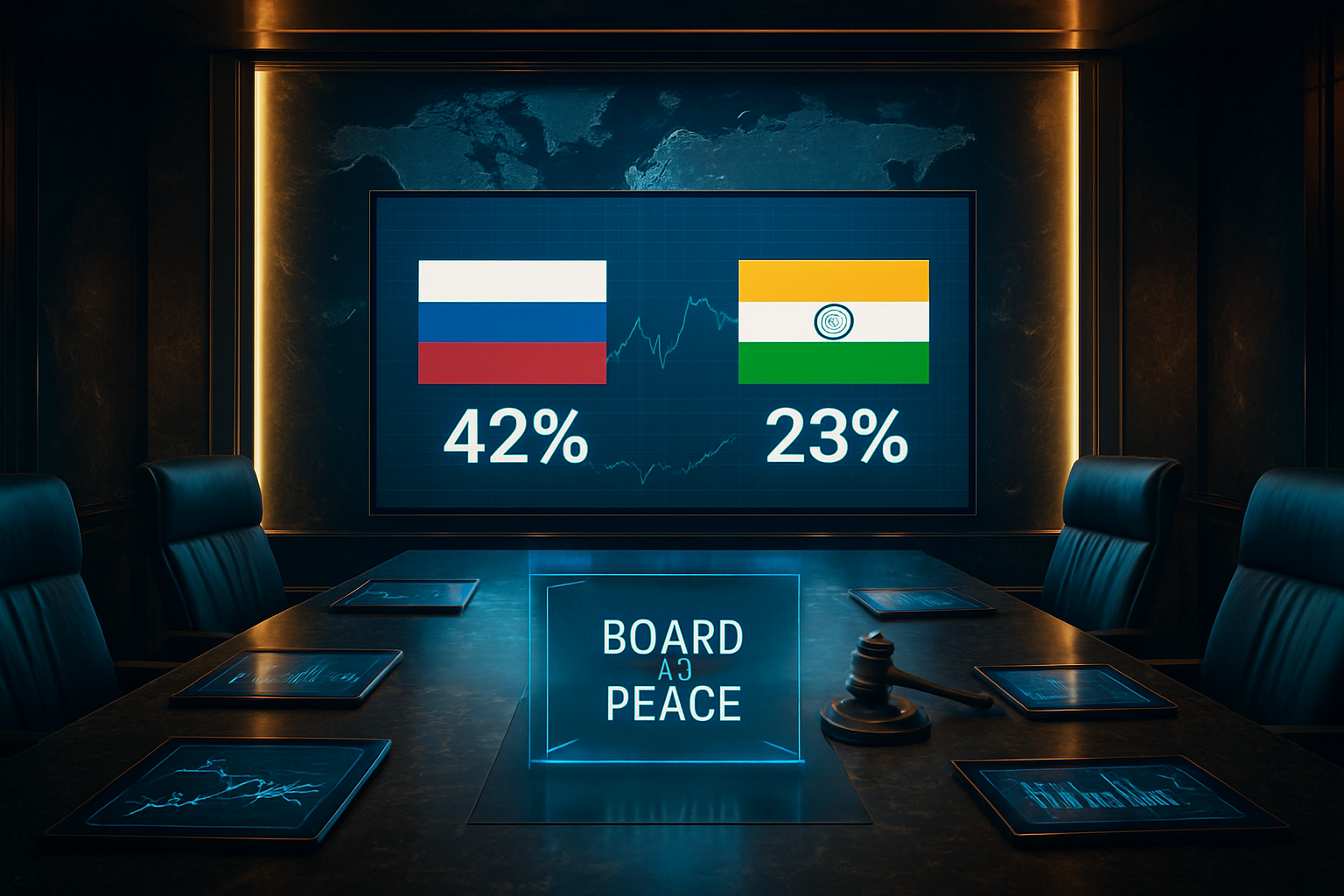

- Global Economic Outlook: Projected global growth of 3.0-3.3% for 2025 and 2026. Moderating interest rates may relieve financial pressures, but geopolitical uncertainty and trade disruptions remain risks. L&T's significant international order book (46% of order book, 50% of FY25 international revenue) provides mitigation.

- Self-Reliance Initiatives: "Atmanirbhar Bharat" and PLI schemes foster domestic value addition and export opportunities for L&T.

- Monetary Policy and Inflation: RBI's rate reductions could stimulate investment. Wholesale price deflation in certain commodities could reduce project costs.

Supply Chains:

- Cost Pressures: Elevated input prices remain a concern, contributing to cost pressures.

- Project Delays: Land acquisition, utility shifting, and environmental clearances hinder timelines.

- Mitigation Strategies: Innovative financing (InvITs, green bonds), technology-enabled monitoring, and supply chain digitization are being adopted. Reshoring/near-shoring for resilience.

Cyclical Effects:

- Inherent Cyclicality: L&T's project business is sensitive to macroeconomic uncertainty and interest rate volatility.

- Government Capex as Counter-Cyclical: Large government spending provides consistent order inflows, insulating against private sector slowdowns.

- Diversification as Buffer: L&T's diversified portfolio and international presence provide resilience against downturns in any single sector or domestic economic fluctuations.

- Commodity Price Swings: Recent wholesale deflation could positively impact project costs.

- Labor Market Dynamics: Labor shortages can impact project execution and costs.

10. Risks and Challenges

Larsen & Toubro Limited (NSE: LT) faces a range of operational, regulatory, and market risks, alongside recent controversies, as of December 16, 2025.

Operational Risks:

- Execution Risks: Delays in complex infrastructure and energy projects due to approvals, land acquisition, and logistical hurdles can impact revenue and profitability.

- Supply Chain Risks: Volatile geopolitical environment, particularly in the Middle East, could lead to adverse outcomes, though commodity inflation has been subdued.

- Talent Risks: High demand for specialized skills in India and international markets poses a talent risk.

- Cyber Security: Potential for cybercrime impacting data security and business continuity, mitigated by a 24/7 Cyber Security Operations Centre.

- New Initiatives Failure: Risks associated with the successful implementation of new ventures in green energy, semiconductors, and other emerging sectors.

- Environmental Damage: Risks related to hazardous waste handling and processing, potentially leading to liabilities.

Regulatory Risks:

- Project Approvals: Lengthy processes for obtaining domestic and international project clearances can cause delays and cost overruns.

- Technical Bid Rejections: A joint bid by L&T and Navantia for the Indian Navy's Project-75(I) submarine program was rejected in January 2025 for technical reasons, highlighting competitive bidding risks.

- Legal & Contractual Disputes: Susceptibility to disagreements over contractual terms, mitigated by clear negotiations and expert risk assessment.

- Tax Penalties: Faced a penalty of ₹4.69 crore from the Income Tax Department in June 2024, which L&T plans to appeal.

- Environmental Compliance: Continuous concern for adherence to environmental regulations.

Controversies:

- CEO's Work-Week Comments: In January 2025, comments by Chairman and MD S.N. Subrahmanyan, perceived as endorsing a "90-hour work week," sparked widespread online criticism, leading to a company clarification.

- MMRDA Tender Dispute: In May 2025, L&T challenged the Mumbai Metropolitan Region Development Authority (MMRDA) over alleged irregularities in a ₹14,000 crore road project tender, leading to the tender's cancellation.

Market Risks:

- Raw Material Cost Volatility: Construction sector faces challenges from fluctuating raw material prices.

- Geopolitical Environment: International business climate under pressure from trade disruptions, tariffs, and conflicts, impacting order prospects for L&T's significant international business.

- Economic Downturns: General economic development and financial market functioning in operating countries directly impact business.

- Competition and Valuation: P/E ratio of 35.09 (as of December 2025) trades slightly below the construction industry average, which some investors might interpret as reflecting specific risk considerations or growth expectations for the company compared to peers.

- Interest Rate Fluctuations: Changes in RBI policy rates can influence borrowing costs.

- Foreign Exchange Risks: Global operations expose L&T to currency fluctuations.

- Liquidity and Investor Sentiment: Shifts in investor sentiment can impact short-term market dynamics.

11. Opportunities and Catalysts

Larsen & Toubro Limited (L&T) is strategically positioned for significant growth, driven by an ambitious five-year plan, expansion into new-age sectors, robust order inflows, and targeted mergers and acquisitions. As of December 16, 2025, the company is leveraging strong domestic and international opportunities.

Growth Levers:

- Infrastructure Dominance: Beneficiary of India's government spending through NIP and Gati Shakti, with the Union Budget 2025-26 allocating ₹11.21 lakh crore for capital expenditure.

- New-Age Businesses: Strategic expansion into green hydrogen, semiconductors, data centers, and defense, projected to be long-term order inflow drivers. Goldman Sachs estimates new-age segments' contribution to order inflow rising from 4% to 15% by FY35.

- Real Estate (L&T Realty): Consolidation under L&T Realty Properties aims to capitalize on India's real estate growth and double revenue by the end of the decade.

- Digital Transformation and AI: Actively integrating AI with over 400 algorithms under development, enhancing operations and client services. Partnership with E2E Networks Limited for cloud and AI innovation.

- Strong Order Book and Execution: Robust and diversified order book of ₹5,64,223 crore (as of December 31, 2024) ensures long-term revenue visibility, with significant international contributions.

New Markets:

- Geographical Focus: Doubling down on India and the Middle East, while exploring new geographies. International revenues constituted 51% of total revenues in Q3 FY25.

- Green Hydrogen and Ammonia: Investing $4 billion over five years to build 2-3 million tonnes of green hydrogen/ammonia capacity, with electrolyzer production commencing in December 2025. Partnerships with ITOCHU and incentives for green hydrogen plants.

- Semiconductor Design Services: Entry into high-margin semiconductor design, acquiring SiliConch Systems.

- Data Centers: Capitalizing on India's digital infrastructure boom with plans for 60 MW capacity.

- Defense and Nuclear Power: Significant long-term growth opportunities in India's nuclear energy expansion and defense manufacturing.

- Renewables: Dedicated 'Renewables' vertical, securing India's largest co-located solar + storage site.

- Real Estate in Oman: Strengthening realty growth in Oman through a dedicated subsidiary.

M&A Potential:

L&T favors strategic "tuck-in" deals for specialized technologies or talent, rather than large-scale acquisitions.

- Recent Acquisitions (2024-2025): Acquired remaining stake in L&T Special Steels, 100% of SiliConch Systems, 15% of E2E Networks, and Paul Merchants Finance's gold loan business.

- Divestments: Completed divestment of L&T Infrastructure Development Projects Limited in April 2024 as part of exiting non-core businesses.

Near-Term Events (as of 12/16/2025):

- Q3 FY25 Earnings (January 30, 2025): Consolidated net profit up 14% YoY to ₹3,359 crore, revenue up 17.3% to ₹64,668 crore, and highest-ever quarterly order inflow of ₹1,16,036 crore.

- Dividend Announcement: Recommended a final dividend of ₹34 per equity share for FY24-25.

- Major Contract Wins (2025): Ultra-Mega Contract from Adani Power, India's largest co-located solar + storage site, significant domestic and international building/factory orders, and a major order for a Pellet and DRI Plant in MENA.

- Electrolyzer Manufacturing: Set to commence in December 2025.

- Strategic Investment Plan: ₹1.5 lakh crore plan focusing on high-tech sectors, part of a $12 billion commitment over five years.

- Consolidation of Realty Business: Active consolidation under L&T Realty Properties.

- Goldman Sachs Upgrade (December 12, 2025): Upgraded to 'Buy' with a ₹5,000 target, citing enhanced earnings visibility and growth opportunities.

12. Investor Sentiment and Analyst Coverage

As of December 16, 2025, Larsen & Toubro Limited (NSE: LT) demonstrates a largely positive investor sentiment, underpinned by strong Wall Street ratings and consistent institutional interest.

Wall Street Ratings and Analyst Coverage:

L&T holds a consensus "Strong Buy" rating from Wall Street analysts. The average 12-month price target is ₹4,427.11, representing a 10.53% upside from a recent price of ₹4,005.20, with targets ranging from ₹3,700.00 to ₹5,020.00.

- Goldman Sachs: Upgraded to "Buy" on December 11, 2025, with a target of ₹5,000.00, citing growth in defense, green hydrogen, and nuclear power.

- ICICI Securities: "Buy" rating with a target of ₹5,020, expecting 18% Return on Equity (ROE) by 2026E.

- Nomura/Instinet: "Buy" rating with a target of ₹4,640.00 (December 2, 2025).

- JPMorgan: "Buy" rating with a target of ₹4,780.00 (November 4, 2025).

Analysts emphasize L&T's healthy order backlog, improving domestic capital expenditure, and strategic moves into high-growth sectors.

Hedge Fund Moves:

Specific details on individual hedge fund activities are not explicitly available, but broader institutional investor trends indicate strong interest.

Institutional Investors:

Institutional investors show sustained and increasing interest. In the September 2025 quarter, institutional holdings increased from 63.05% to 63.06%.

- Foreign Institutional Investors (FII/FPI): Increased holdings from 19.33% to 19.48%.

- Mutual Funds: Increased holdings from 20.31% to 20.55%.

L&T's status as a large-cap company and Nifty 50 constituent makes it a preferred choice for institutional investors.

Retail Chatter:

While specific social media sentiment is not detailed, high value turnover and active participation in December 2025 trading sessions indicate strong retail investor interest. The stock trading near its 52-week high suggests elevated market expectations among investors.

13. Regulatory, Policy, and Geopolitical Factors

Larsen & Toubro Limited (NSE: LT) operates within a dynamic interplay of regulatory frameworks, government policies, and geopolitical forces that significantly shape its business environment as of December 16, 2025.

Laws, Compliance, and Corporate Governance:

- SEBI Regulations: L&T complies with SEBI (Depositories and Participants) Regulations, 2018, and SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, ensuring transparency.

- ESG Framework: A pioneer, L&T launched India's first listed ESG bond in June 2025 under SEBI's new framework, raising ₹500 crore. Committed to water neutrality by 2035 and carbon neutrality by 2040.

- Corporate Governance: Strong framework emphasizing transparency, integrity, professionalism, and accountability, with an independent Board and various committees.

- Taxation: Faced a penalty of ₹42.5 lakh in December 2024 for disallowing transitional credit, which the company plans to appeal.

Government Incentives and Policy Support:

- Infrastructure Sector Boost: Union Budget 2025-26 increased capital investment outlay to ₹11.21 lakh crore, including interest-free loans for states' capital expenditure.

- PM Gati Shakti: Driving integrated infrastructure development, benefiting L&T with major EPC contracts.

- National Infrastructure Pipeline (NIP): India targets US$1.4 trillion investments by 2025 under NIP.

- Defense Indigenization & Exports: "Make in India" and defense modernization initiatives offer significant opportunities. Government aims for defense exports of ₹30,000 crore in FY26, rising to ₹50,000 crore by FY29. L&T is a leading private-sector defense manufacturer.

- Production Linked Incentive (PLI) Schemes: PLI schemes across 14 sectors boost domestic manufacturing and attract investments, benefiting L&T Semiconductor Technologies.

- Green Energy Initiatives: L&T's investments in green hydrogen and electrolyzers align with national climate goals and receive government support.

Geopolitical Risks and Opportunities:

- Geopolitical Instability: Conflicts (e.g., India-Pakistan, Eastern Europe, Middle East) impact order intake, working capital, and margins for international operations.

- Trade Disruptions: Global trade disruptions, tariffs, and protectionist policies pose risks to market entry and supply chains.

- Supply Chain Vulnerabilities: Geopolitical conflicts and climate disruptions affect operations and increase costs.

- International Opportunities: Despite risks, international business is a significant growth driver (58% of FY25 order inflow, 70% in Q4FY25). L&T focuses on India and the Middle East, securing heavy engineering orders globally.

- Defense Export Market: Government's ambitious defense export targets create global expansion opportunities.

- Cybersecurity Threats: Escalating state-sponsored cyber activities pose a critical risk to critical infrastructure.

14. Outlook and Scenarios

Larsen & Toubro Limited (NSE: LT) is charting an ambitious future, demonstrating resilience amidst global challenges and strategically pivoting towards high-growth, high-margin sectors, as evidenced by its performance and outlook as of December 16, 2025.

Bull Case:

- Robust Order Book: Exceeding ₹6.5 lakh crore, with a prospect pipeline of ₹8.1 trillion, ensuring multi-year revenue visibility.

- Government Infrastructure Push: Continued government investment under 'Make in India' initiatives drives opportunities.

- Strategic Diversification: ₹1.5 lakh crore investment in semiconductors, green hydrogen, data centers, and real estate, enhancing long-term competitiveness.

- Technological Advancement: Active integration of AI with over 400 algorithms under development.

- Strong Financial Position: Substantial cash reserves (₹50,000 crore) and minimal debt support investment plans.

- Execution Prowess & International Expansion: Strong execution capabilities and major international projects, especially in the Middle East.

- Positive Analyst Sentiment: "Buy" consensus with significant upside potential, forecasting 20.2% annual earnings growth and 14.3% revenue growth.

Bear Case:

- Global Macroeconomic Risks: Volatile global business environment, trade disruptions, tariffs, geopolitical shifts, rising interest rates, and commodity price volatility.

- Slowdown in Specific Segments: Q3 FY25 saw slowdowns in public and episodic private investments, and a decrease in hydrocarbon and carbon-lite prospects.

- Margin Pressures: Lower operating margins in the ITTS segment in Q3 FY25.

- Valuation Concerns: P/E ratio of 36 (January 2025) is a 24% premium to its 5-year median, suggesting a higher valuation.

- Short-term Volatility: Stock has shown volatility, with a 5.25% YTD decline as of late July 2025, reflecting sensitivity to news and cyclical business nature.

Short-term Projections (Q4 FY25 – FY26 / end of 2025 – mid-2026):

- Earnings and Revenue: Another year of double-digit revenue growth and continued margin improvement.

- Share Price Targets: Approximately ₹3,950 to ₹4,200. Current trading around ₹4,062.65 to ₹4,090.95.

- Outlook: Positive due to strong order inflows and government spending, but subject to global economic conditions and profit booking.

Long-term Projections (FY27 onwards / 2027-2030):

- Share Price Targets:

- 2026: ₹4,300 to ₹4,958.88.

- 2027: ₹4,750 to ₹6,222.66, driven by international projects and technology.

- 2030: ₹6,300 to ₹6,800. Walletinvestor.com predicts ₹7,047.717 by December 2030 (over 72% 5-year return).

- Growth Drivers: Strategic pivots into green energy, high-tech manufacturing, defense, and digital transformation. Expansion in the Middle East and AI adoption.

- Financial Health: Aim to increase ROE to 18% and reduce working capital.

Strategic Pivots:

Guided by its new five-year plan, "Lakshya 2031":

- Deepening Core Strengths: Doubling down on infrastructure in India and the Middle East.

- High-Tech Sector Investments: ₹1.5 lakh crore for semiconductors (design services), green hydrogen, data centers, and real estate.

- Embracing AI: Deploying numerous AI algorithms.

- "Grow to Sell, Sell to Grow": Scaling high-performing businesses and exiting non-core segments.

- Targeted Acquisitions: Smaller "tuck-in" acquisitions for specialized technologies.

- Operational Excellence: Enhancing agility, capital discipline, and operational excellence.

15. Conclusion

Larsen & Toubro Limited (NSE: LT) presents a compelling investment case as of December 16, 2025, driven by its robust financial performance, strategic foresight, and integral role in India's and the global infrastructure and technology landscape.

Summary of Key Findings:

L&T's Q2 FY26 results showcased a 15.6% YoY increase in consolidated net profit and a 10.4% rise in revenue from operations. The company's order book stands at a record ₹6.67 trillion, with a significant 65% contribution from international orders, ensuring long-term revenue visibility. L&T is strategically diversifying into high-growth, high-margin sectors such as defense, green hydrogen, nuclear power, aerospace, and semiconductors, which are expected to be substantial order inflow drivers. Goldman Sachs projects these new segments to contribute 15% of order inflows by FY35.

Balanced Perspective:

Analyst sentiment is overwhelmingly positive, with a "Strong Buy" consensus and an average 12-month price target suggesting a significant upside. Projections indicate strong double-digit annual earnings and revenue growth. However, a balanced view acknowledges some challenges, including occasional misses on Street estimates for PAT, relatively flat margins in recent quarters, and increasing competition in the domestic project market. Broader macroeconomic factors, geopolitical realignments, and global supply chain disruptions also pose ongoing risks. The stock's current valuation, trading at a premium to its 5-year median P/E, also warrants careful consideration.

What Investors Should Watch For:

Investors should closely monitor:

- Sustained Order Inflow and Execution: The company's ability to continue securing large contracts, particularly in new growth verticals and international markets, and execute them efficiently.

- Margin Trajectory: Observe the strengthening of EBITDA margins as projected through the FY28–30 execution cycle.

- Progress in New Growth Verticals: The successful development and scaling of businesses in defense, green hydrogen, nuclear power, aerospace, and semiconductors.

- Domestic Capital Expenditure: Continued strong government budgetary support for infrastructure and increased private capital investment in India.

- International Performance: Sustained robust performance and order wins from international markets, especially the Middle East.

- Digitalization and Sustainability Initiatives: L&T's commitment to and progress in embracing digitization, sustainability, and climate resilience as foundational elements for its future growth strategy should be observed.

- Competitive Landscape: How L&T navigates and maintains its market position amidst rising competition from other EPC players in the domestic market.

- Share Price Momentum: With the stock trading near its 52-week high, investors should watch for sustained breakouts above resistance levels, as indicated by technical analyses, to confirm continued upward momentum towards analyst-projected targets.

Larsen & Toubro Limited, with its diversified portfolio, robust order book, and strategic pivots towards future-ready technologies, remains a formidable player in the global engineering and construction landscape. Its ability to capitalize on India's growth story while expanding internationally, coupled with a focus on innovation and sustainability, positions it as a key entity for long-term investors.

This content is intended for informational purposes only and is not financial advice